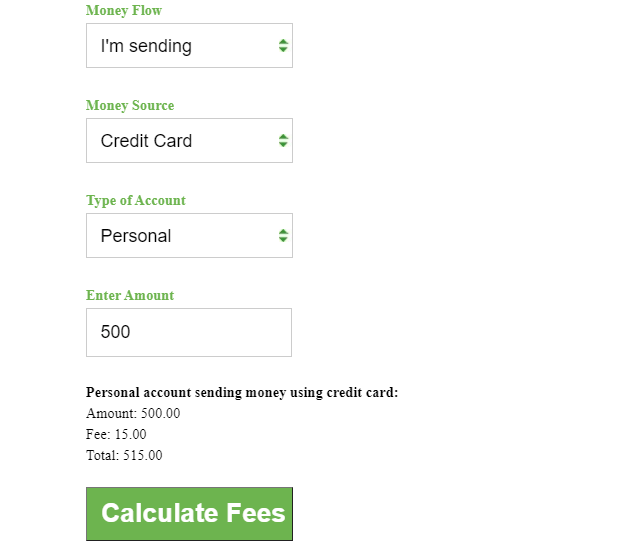

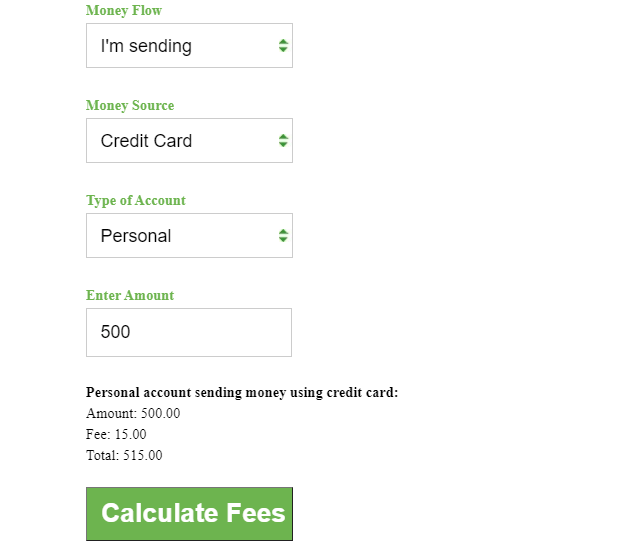

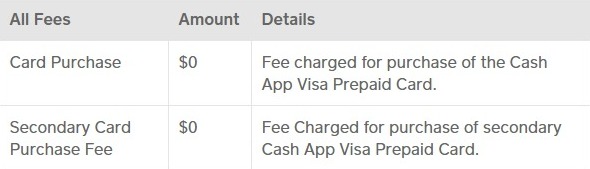

Check out the pricing widget for more details. The Cash app has two types of transfer limit.

Cash App Calculator Withdrawal Sending Fees Mysocialgod

149 trade fee for transactions from a US Bank Account.

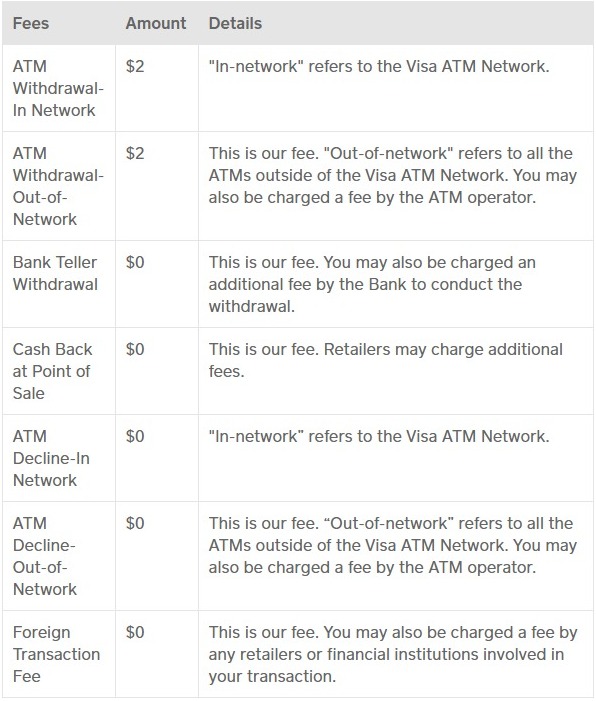

. Venmo charges a non-refundable fee of 19 plus 010 on every seller transaction. Some fees like ATM charges will be reimbursed up to 3 times per month and up to 7 per withdrawal if you receive at least 300 in direct. Tap your Profile in the upper left corner.

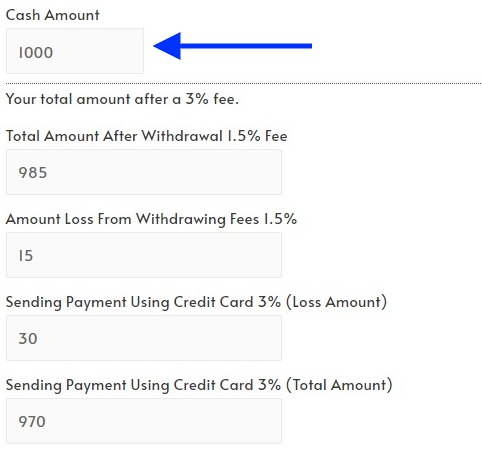

With Instant Transfer limits dont include fees. Cash App charges a 3 fee when paying by credit card and a 15 fee for instant transfers. Square Fee Calculator.

Lodefast check cashing app allows you to cash your personal check on mobile phones. Best for flexible payments. Cash App Support Cash Out Speed Options.

If you change your mind you can disable automatic transfers by following the same steps and toggling the switch off. Bank account or VisaMastercard debit card typically within 30 minutes. A maximum international fee of 499 USD.

PayPal instant transfer limit⁴. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. You can send up to 250 in a single transfer or as multiple transactions in any seven-day window before Square Cash will demand further.

A limit requiring ID. Minimum amount is 25 USD and maximum is 10000 USD in a single transfer. PayPal balance or a bank account.

Up to 15000 per month. Scroll down and toggle Auto Cash Out on. 149 trade fee for transactions 10-25.

Transfers to cards typically take a few minutes but can take up to 30 minutes. Standard deposits are free and arrive within 1-3 business days. To send a payment.

Instant transfer to a bank account. For Instant Transfer a 15 percent fee with a minimum fee of 025 and a maximum fee of 15 is deducted from the amount of each transfer. Launch the Square Cash app on your iPhone.

To receive this amount after fees. Enter the amount you want to send. This is an.

199 trade fee for transactions 25-50. That means if a business profile receives a 150 payment 295 of the payment is charged as a seller transaction fee and the business owner receives 14705. Square Checking is provided by Sutton Bank Member FDIC.

Debit card or prepaid card in the Wallet app you must be at least 13 years old. 2 Venmos instant transfer fee will be 15 of the amount youre trying to cash out with a maximum of 15. If a person sends you.

New Square sellers may be limited to 2000 per day. And you would receive. Reverse Square Fee Calculator.

Note that Venmo users paying a business using a credit card dont incur the regular 3 n a particular. Instant transfer to a card. Instant transfers allow you to send money from Venmo to an eligible US.

You can be able to transfer money to your bank account from anywhere and at any time. If you request to transfer money to a bank account the. Instant Deposits are subject to a 05 -175 fee with a minimum fee of 025 and arrive instantly to your debit card.

As a peer-to-peer P2P payment platform Square Cash must put in place limits to prevent fraud and abuse. A person would have to send you. Coinbases Fees are far higher than investing in the stock market.

The fee for sending domestic transactions applies plus the additional percentage-based fee for international transactions international fee. Payments to other Revolut users and card payments are instant. A minimum international fee of 099 USD.

A 15 fee with a minimum fee of 025 and a maximum fee of 15 is deducted from the transfer amount for each transfer. If you want to use the instant transfer service there are some limits you need to know about. Funds are subject to your banks availability schedule.

Selects picks for the top apps to send money. Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. 050 fee for transactions above 200.

Ad Western Union makes it easy to send money online with our app or at an agent location. International transfers can take up to 3 to 5 business days to reach the recipients account. To have an eligible US.

Cash App also charges a 15 percent fee if you request an Instant Transfer of funds from your Cash App account to your linked debit card. Select whether to have money deposited instantly for a 1 fee or 1-3 Days free. The peer-to-peer payment app announced several changes this week in an email to its 70 million users updating its privacy settings small business policy and perhaps most notably instant transfer fee.

Lodefast check cashing app. Feel free to take a quick look at our fees page for more information. To transfer money to or from an eligible debit.

Check out NerdWallets Best Online Checking Accounts. Cash app transfer limit. Different payment methods affect your transfer delivery time.

Easily send money to 200 countries and territories around the world. Figure out how much you are going to have to pay in square fees or how much to send to make sure the other person gets the correct amount. Your Square fees would be.

Instant and same-day transfer require a linked bank account or debit card and cost a fee per transfer. Lodefast financials mobile app charges processing fees which vary from 3 to 5 of each check you want to cash. 299 trade fee for transactions 50-200.

Up to 5000 per transaction 5000 per day and 5000 per week in total. Best for bank-to-bank transfers. Open the Cash App mobile app.

099 trade fee for transactions 0-10.

2022 Cash App Fee Calculator Square Cash App Instant Deposit Fee Calculator

2022 Cash App Fee Calculator Square Cash App Instant Deposit Fee Calculator

2022 Cash App Fee Calculator Square Cash App Instant Deposit Fee Calculator

Cash App Calculator Withdrawal Sending Fees Mysocialgod

Cash App Calculator Withdrawal Sending Fees Mysocialgod

Cash App Instant Deposit Fee Calculator 2022 Cashapp Fee Calculator

0 comments

Post a Comment